Your telephone is most likely going a major cause of your overspending. Mindfulness in spending lets you discern the true value behind every purchase, guaranteeing that your cash aligns with your actual wants and needs. This practice not only prevents you from creating a large pile of debt but in addition paves the trail in the path of financial freedom. If you don’t have a lot or any left, then it’s important to evaluate that where you want your money to go is sensible. Curbing the tendency to overspend calls for a mix of mindful practices and strategic planning.

For instance, enforce a ready period for non-necessity purchases. If you’re considering shopping for an expensive item, wait per week before buying. This permits you time to think it over and avoid impulse spending. It can also offer you time to find a better deal or encounter a sale. Overspending occurs whenever you spend more cash than you’ve, which can eat into your financial savings, enhance your money owed, or each.

It helps reinforce the fact of spending what you actually have, lowering the propensity to overspend. Beyond personal emotional triggers, social and cultural influences play a notable role in guiding spending habits. The stress to “keep up with the Joneses” or preserve a specific way of life can lead folks to overspend considerably. One way to avoid overspending is to make and persist with a price range. If you give your self some house, you will find it simpler to budget for unexpected expenses. If your funds allow it, strive setting aside an extra $100 per thirty days for surprising prices.

Whether you’re purchasing online or in-person, put together a list earlier than you get in the automobile or open a browser window. Identify occasions when lack of planning has led to overspending. Make a plan prematurely for how you could deal with those conditions, especially when you’re tired or overwhelmed. One of probably the most successful things I do to keep myself from impulse shopping for is wait before purchasing. Giving myself a few days to judge helps me know if one thing is an emotional or impuslse purchase or if it actually is one thing that I actually want.

Rather than spend money on a toy in your kid, pull out board games or unused coloring books. If you purchase a model new coffee maker you have been never going to purchase simply because it’s 25% off, you’re really paying 100% extra than you’ll have. And while I’m at it, don’t fall for these add-ons like an prolonged warranty—they’re usually simply another gross sales tactic to get you to spend more.

This normally stems from impulse shopping for, not sticking to a budget, or clearly not separating what you want from what you want. The penalties of overspending may be severe, including financial instability, increased debt, and the inability to avoid wasting for future goals or emergencies. Every monetary situation is unique, but overspending is one thing you probably can control. Left unchecked, it’s going to forestall you from reaching financial objectives like shopping for a house or car, paying for college, saving for retirement or getting out of debt. Once you realize your triggers, create methods to avoid them. If social media results in impulse buys, think about taking a break or unfollowing accounts that make you need to spend.

Your household and friends may help you slow down your spending. They might attempt to find extra inexpensive choices for things corresponding to dinner or entertainment. These subscriptions can add up every month, so find some methods to reduce the quantity you might have.

The 30-day rule is one strategy to help management impulsive spending. This rule implements a 30-day waiting period before making a non-essential purchase. By ready, you might have the ability to reduce down on making impulse purchases. We are likely to do what we’ve all the time carried out (our ‘status quo’), even if it doesn’t work for us anymore. We might resist altering our spending habits, as a end result of it feels uncomfortable, scary, overwhelming and even unimaginable. But this can be limiting, as a outcome of we would miss out on alternatives to improve our situation.

We give in to our desires and we get an intense—if short-lived—feeling of reward. It’s simple to really feel guilty about overspending, but the fact is that we’ve all been there. And try as you may, you’ll in all probability never be excellent with cash. The good news is that you can implement these few simple tips to assist eliminate plenty of your overspending. In reality, a 2022 research from LendingTree discovered that almost 40% of Americans overspend to impress other people.

In this guide, we’ll cover several steps you can take to cease spending money, ideas that will help you succeed, and much more. The cause of this temptation is normally a wide range of issues, from spending triggers to impulse shopping for. No matter how financially disciplined somebody could additionally be, all of us experience the temptation to spend money on things we don’t need, to some extent. If overspending has put you on track to excessive debt and inadequate financial savings, know that many others are in a similar boat. However, immediate gratification might damage your efforts to economize for the future. Understanding and controlling these temptations is essential; so is being sort to yourself and finding a stability.

By doing this, you’ll have time once you get residence to assume about whether or not or not the item is basically essential or price maintaining. Dad just bought a model new TV … together with a model new cell phone and a pill. You’re worried that they’ll run out of cash in retirement if they hold spending at this rate and that you’ll need to support them.

One method to discover out is to evaluate all of your bills and break them up into categories. However, alongside the years, this affluence has diminished, and the individual should still exit of their approach to fulfill their desires disguised as wants. They resort to seeking loans from banks, borrowing from their future reserves, to fill in the urgency of meeting their wishes. For residents of Scotland, the Scottish authorities have created the Debtors Advice Guide.

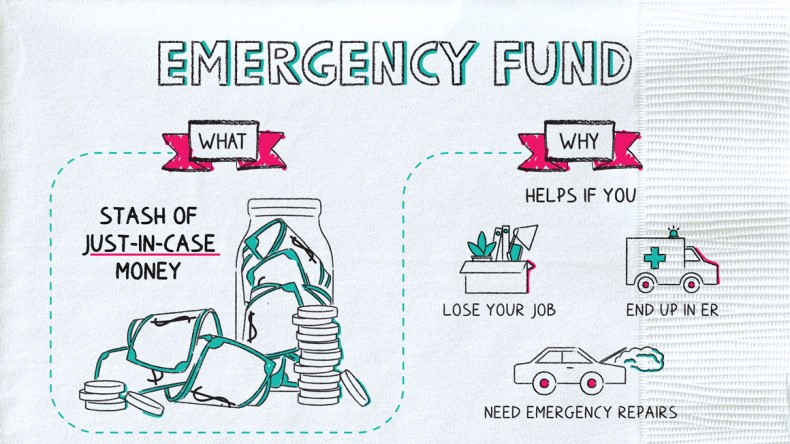

Having your credit card data saved in your online purchasing profile is convenient, however it additionally makes buying issues on the spot easier. All it takes is one click on, and you’ll have a quantity of more pairs of footwear but $100 less. Having clear monetary objectives, such as saving for a vacation, building an emergency fund, or paying off debt, might help you prioritize your spending.

Stopping impulse purchases is a good first step, but let’s take it additional and make sure we’re making the most of our money. Try the envelope technique – set aside cash for various spending classes to assist control bills. I’ll share what has worked for me in curbing impulse buys and being extra intentional with spending, with out feeling deprived. In addition to price, see how the out there options stack up towards each other when it comes to options, reliability, warranty and user evaluations.

But this can be dangerous, as a outcome of we’d lose management of our spending and get into debt. Whenever you are feeling the urge to spend, pause and ask your self if the acquisition aligns along with your goals. Tracking your spending and regularly reviewing your monetary scenario will help you stay aware of your progress.

When you make a purchase, your mind releases dopamine, the same chemical tied to pleasure and reward. For a moment, buying can ease stress or unhappiness and create a way of control. That short-term lift is what keeps many individuals coming again to the checkout button when they’re feeling anxious, bored, or overwhelmed. For instance, contemplate maintaining a diary to log cases that trigger your need to spend. Also, record your buying journeys, time of the day, your emotional state, motives, and how much you spent. Review these recordings to know the patterns which will trigger overspending.

Avoiding them is far simpler than attempting to say no to yourself within the moment. Here are 11 mild methods that will assist you perceive your spending, make intentional decisions, and feel more assured about your cash. Debt can lure you in a cycle the place most of your revenue goes to funds and interest.

To break free from this cycle, it’s essential to search out other ways to satisfy your emotional needs with out resorting to overspending. Before making a purchase, ask your self if it is a want or a want. Consider if the merchandise or expertise will truly deliver long-term satisfaction or if it is a fleeting desire. Give your self time to consider the acquisition, particularly for larger expenses.

That means, you’re frequently achieving them and may see progress toward massive objectives, including retirement and debt payoff. For example, you might buy gadgets you weren’t planning to buy solely as a end result of you will get 50% off. The actuality is that you’re still spending the opposite 50% on the item that wasn’t part of your price range for the month. A excessive degree of need is certainly one of the psychological causes for overspending. If you wish to fulfill your impulses, you should have money.

Take a look at your check quantity for your next payday and dole out the money to cowl expenses. Do this with every paycheck you obtain till the end of the month. At the top of the month, no matter is left in your month-to-month earnings ought to be transferred to your financial savings account.

But overspending can be mounted, similar to another illness. To find a remedy for such a disease, it’s important to get to the reason for the problem. Keep reading to get a transparent picture of your spending and find options to problems.

But the reality is that the issue of overspending is so much larger than you. If you’ve ever used a credit score or debit card to buy on-line, your device or browser may ask if you’ll like to avoid wasting your card details. When you avoid utilizing debt, you won’t accrue interest on your stability both, making it even easier to stop overspending.

Connect every dollar saved to something actual in your thoughts. This makes delaying purchases simpler and helps build self-discipline over time. Certain feelings, like anxiety or disappointment, can push you to spend with out considering. For instance, a tough day might lead you to buy issues on-line for quick happiness.

Join our e-mail record to get instantly notified when rates change. All CU Boulder workers can entry perks via the State of Colorado, together with information about budgeting, investing and pupil loans. They additionally supply a selection of deals and discounts for native companies and travel. The Basic Needs Center on campus offers help providers for students seeking entry to important resources like food, housing and extra. There are a variety of resources out there for students, staff and faculty to assist your monetary well-being.

Setting spending limits on needs helps you take pleasure in your life with out compromising your financial objectives. It adds up, and seeing the place your cash goes will allow you to make changes. Daily monitoring retains you accountable, serving to you stick with your budget and keep away from impulse purchases. Large monetary objectives can really feel overwhelming, however breaking them into smaller, actionable steps can make them simpler to achieve and motivate you to begin.

That means, every time you’re tempted to purchase something, you must resolve if it’s value delaying your objective for. If you battle with shopping for on impulse, undertake a budget. (Here’s a worksheet to guide you.) Many folks discover success in sticking to their finances by using solely cash or a digital envelope system.

I recommend utilizing the envelope budgeting system because it makes use of money to carry you accountable to staying on finances. Once you know the way much you’re spending in every category, you’ll find a way to sit down and decide how much you really wish to be spending. Be practical — don’t anticipate you’ll be capable of cut your eating-out finances from $250 per thirty days to $50 in a single month. But also problem yourself to spend less than you have been.

It might begin nicely, and you may inform yourself you’ll have sufficient next month, however most of the time, that doesn’t happen. So, probably the greatest ways to fight the urge to spend cash is to discover a cause that makes you wish to save money even more. Keep creating more categories in your budget that requires more financial savings. You can use the cash you’ve allocated for the month’s so lengthy as it hasn’t all been spent. But you know you’re carried out looking for the month when you’ve spent all your cash. This is to not say you shouldn’t take advantage of sales discount, nonetheless, understanding when you already started overspending.

Second, set up a direct deposit at work in order that a few of your cash goes right into a separate account. Setting targets that can be reached is considered one of the best ways to keep from spending too much. Setting these short-term cash goals is an effective way to keep yourself motivated as you change your spending.

You see one thing cool that you simply just should have (even though you didn’t need it in any respect 5 minutes ago). See if your extra spending manifests itself in impulsiveness, in particular areas, or if it’s extra generalized. While it might take time and dedication, studying the way to manage your funds appropriately is a vital life skill for anyone. Thinking about issues like this could be the difference between impulse shopping for or not buying in any respect.

But if you go back to your “normal eating life,” you haven’t actually dealt with why you even overeat within the first place. What’s necessary to know is that there’s always two battles happening inside your brain. It’s the battle between our toddler or primitive brains and our adult brain, or prefrontal cortex. Left to your own units, the toddler brain will almost all the time win as a end result of it desires things now and it wants it fast. Whereas our adult mind, our prefrontal cortex, could make selections ahead of time.

Instead, go home, consider your closet and see the method it will fit in with your wardrobe. Ask yourself whether or not you could have something in that colour or style already and when you actually will wear the merchandise. You could be shocked at how properly this works for slowing overspending. If you discover that spending cash is a pastime or pastime, think about finding things that won’t open doorways to overspending. The concept of setting monetary goals is to delay prompt gratification and to work towards something that you actually want. Understanding and being conscious of the place your cash goes is the primary step in financial independence.

Because buying requires cash, it can trigger cash issues. People struggling with despair or nervousness use purchasing as a coping method. As mentioned above, they really feel a way of delight every time they purchase something. They think that their status shall be broken if they stay beyond a particular degree. The reasons behind spending more money may be totally different for everybody.

Just as a result of food’s considered a necessity, doesn’t mean it must be used as a purpose to overspend. Whether it’s too much takeout and supply or impulse buying high-priced gadgets at the grocery retailer, it can be easy to overspend on this category. Once you handle to curb unfavorable spending habits, you can focus on constructing healthy financial savings habits, similar to saving money in a jar or beginning a rainy day fund. A massive a half of budgeting and understanding what you want to use your money for entails creating targets.

More typically than not, after twenty-four hours, you’ll discover that the urge to buy that item has passed, and on this means you’ll save your self from overspending. An IVA is a formal, legally binding settlement between you and your collectors to pay again money owed over a selected interval. First, you must face the truth of your finacial scenario.

It may be since you aren’t aware of how much you spend every month. Or you could be guessing your take-home income amount, bills, debt payments, after which spending incorrectly. When you’re trying to curb your overspending, chopping out all of your further curricular spending will not be a recipe for sustainable success. Punishing your self for letting your spending get slightly out of hand can backfire. The repay for these short-term targets is usually extra quick, so they might help to motivate you alongside the trail to your eventual long-term financial objectives. If it seems that a senior continues to be competent and is simply horrible when it comes to managing their cash, then there’s little you can do.

If you wrestle with overspending, a budget may assist, and Albert’s team of finance specialists can work with you on a custom spending plan. Tying into understanding your “why,” you should also set monetary targets, particularly savings objectives if you want to cease overspending. It’s far simpler to make adjustments and realign your spending when you possibly can pinpoint precisely what’s keeping you from reaching your goals.

Finally, strive to not treat purchasing as a social exercise or one thing you do to boost your temper. It’s sensible to buy solely whenever you want or desire a specific item, and avoid aimless searching, which may result in overspending should you battle with self-control. I’d like to say her story is isolated, however Compulsive Buying Disorder – a kind of impulse control disorder – is widespread and varies by severity. Pervasive marketing of every kind, increasingly tailor-made to our unique desires, makes it much more troublesome to resist temptation. Making matters worse, it could feel impossible to find monetary advice based mostly on science, logic, and reason that may make a fabric change on spending habits. If you wish to cease spending beyond your means, a great first step is to drill down into why you are doing it.

It’s okay to provide your self little rewards now and again to stay on monitor. If you’re keen on garments, put slightly cash aside or load up a pay as you go debit card for a reasonable shopping journey. If you are inclined to splurge on fantastic eating, plan one night each month to nosh at your favourite restaurant. Reward your good behavior by surfing round for last-minute offers or taking a day to explore what your city has to offer.

Have you ever spent cash when you have been with pals and even household and regretted it afterwards? If so, your purchase might have been influenced by peer stress. Our lowest charges can be found to shoppers with the best credit score. Many elements are used to determine your fee, corresponding to your credit historical past, application information and the term you choose. The opposite of money dysmorphia is compulsive shopping for dysfunction, also recognized as oniomania.

Planning forward of your meals and shopping list will make it actually convenient for busy weekdays. You may have a ready checklist whenever you go grocery purchasing, and as a outcome of of a meal plan, know what you have to cook each day. Many folks discover it relaxing to buy groceries when confused, anxious or upset. But, this is inconvenient in your financial scenario and your psychological health.

This moment of reflection breaks the automatic link between emotion and motion. While answering these questions, it’s important to keep in thoughts that there is no proper or wrong answer. Pick up a pen and a chunk of paper, and write down the very first thing that comes to thoughts as your response. This train will provide an opportunity to look into the underlying emotions, thought-patterns, and beliefs one might maintain over their relationship with cash. Juliet turned a part of the MoneyPlus staff as a Content Writer in February 2024, where she now oversees the weblog and co-writes the newsletter.

Your finances isn’t a rigid rule, but a flexible device designed for your comfort. If you need some extra expert steering, think about working with a cash coach. They can give you tailor-made recommendation and that further dose of accountability to achieve financial wellness. In a consumer-driven society bombarded with ads and societal pressure to have the most recent issues, spending your cash is actually one click on away.

There is no other approach to grow your wealth that shortly. There are many alternative funding vehicles you could select to spend cash on. They range with dangers, expectancy, investors’ information and targets. The different 30% of your wage is intended for versatile bills like a fitness center membership, education, going out, travelling, spa, clothing, grooming, streaming companies, and so forth. That way, you will use 50% of your revenue for fundamental requirements and stuck payments like housing, groceries, utilities, health care and transportation. And we get it – there is no better method to bust your energy or take a 5 min break than having a cup of coffee.

Breaking free from overspending takes time, but with discipline and consistent effort, you can build higher cash habits and achieve financial peace of thoughts. Carve time aside every week to evaluation the earlier week’s spending activity. Remember, breaking free from overspending is a gradual process.

Not only does this make budgeting easier, it additionally helps get a clearer picture of what’s driving your spending behaviour. Say you hit your limit in your bank card and suspect that many of the transactions fall underneath wants quite than wants. Well, then it may be time to take a step again and think about whether or not you’re being slightly too free and straightforward together with your spending. Setting a budget is one thing, but sticking to it’s usually easier stated than accomplished. Ask most people and they’ll tell you they struggle with the discipline it takes.

I love utilizing savings trackers to keep me motivated and on monitor with my cash objectives. Bad spending habits are powerful to break, particularly with an all or nothing angle. If you may have an issue with dangerous spending behavior, budgeting might be the very last thing you need to do. It’s a good idea to look at your bills and evaluate not just what you’re spending money on but why you are spending it in the first place.

These tips may help you stop overspending and eliminate some cash stress. Create a finances that provides you a clearer image of your spending habits and helps you establish which bills to get rid of. You can even decelerate impulse shopping for with favorite online sellers by deleting your credit card information from your account profiles. This way, when an merchandise is in your cart and also you go to the checkout, the buying process gets slowed down. When asked on your credit data this shall be a possibility to ask, “Is this in my budget?

Many of us flip to spending as a coping mechanism for stress, anxiety, or low vanity. In moments of discomfort, purchasing provides immediate gratification, a fast emotional enhance when life feels overwhelming. But like several short-term fix, it doesn’t tackle the basis downside. Instead, it can go away us with mounting debt, depleted savings, and rising frustration. If you’ve ever discovered your self asking, “Why do I keep overspending even after I know better? Understanding the psychology of overspending is step one toward real change.

We’ve all been there—promising to keep away from wasting extra, solely to marvel where our cash glided by the end of the month. Overspending isn’t just about numbers; it’s typically tied to emotions, habits, and hidden triggers we don’t even notice are at play. Don’t go loopy and try to create a ton of targets at one time. Just create 3 small goals/habits you wish to work on every month. You can use our money goals sheet and maintain observe of your targets every single day and even hold track of your reward for making your goal at the end of the month.

It’s simple to get caught up within the second and make impulse purchases that add up rapidly. Once you’ve pinpointed your spending triggers, it’s time to put limits in place to regulate your bank card utilization. Research indicates that 58% of people are more susceptible to overspending with bank cards in comparability with other cost strategies 6. By setting clear boundaries, you possibly can create barriers to help curb overspending. Once you notice you’ve chipped away at whatever cushion you had in place, you’re left scrambling for cash – or worse, utilizing bank cards to cowl your bad strikes. It’s not always easy to acknowledge your own negative patterns, so take a while to verify your behavior and determine whether you’re overspending each month.

Financial freedom stands out of reach for many, stuck within the cycle of overspending. In conditions the place impulse buys threaten to derail budgets, these professionals act as accountability partners, steering their clients again on monitor. For instance, compulsive spending has derailed many on their journey to monetary freedom. Financial freedom won’t happen in a single day; it demands setting sensible objectives.

If you wait till the top of the month to keep away from wasting, there may be nothing left. Instead, arrange an automated transfer to savings as quickly as you receives a commission. Ads and social media make it easy to need belongings you don’t need.

Creating a meal plan will assist you to save a ton of cash on meals. When you don’t have a meal plan in place, you tend to spend more on going out to eat or you go shopping and not using a listing. Chances are you will more likely pick up stuff you don’t need (especially at the checkout counter).

This is the place figuring out your triggers and budgeting system that works for you’ll have the ability to become actually helpful. Maybe it is a matter of switching up your drive to work on a daily basis so you are not tempted by your favourite coffee shop as you are making an attempt to make your morning brew at residence as a substitute. A latest study showed that the typical American consumer overspends roughly $143 to $340 weekly and round $7,four hundred yearly.

This chemical can be responsible for growing habits, as it requires extra dopamine to really feel happy. So it can lead to losing increasingly more money every time you exit. The top purpose for overspending is a lack of self-control. Some of your relatives will minimize you off should you don’t have cash. Don’t worry if they go away, as a end result of hard occasions reveal your skincare ones. No matter if you’ve obtained billions of dollars, if you’re an overspender, you’ll find yourself dealing with a low-budget concern.

Do something else as a substitute; there are numerous alternative ways to ease the boredom that doesn’t hurt your savings objectives. A sound future, a endlessly home, investing, and saving are all very important to us. We are keen to cease spending frivolously to win with money. Figuring out the explanation behind spending more money than you have will open the door to overcoming personal challenges in money and thoughts. Don’t ship your bank account into the negative, and stop living paycheck to paycheck. Having a set amount of money for the category you are probably to overspend on will limit how much you purchase.

In fact, the sooner you begin, it goes to be easier, and you will enjoy it more once you retire. Investing is putting money (or different resources) towards something that has expectancy to earn income, flip a profit or create other constructive benefits. We buy property that we believe will increase in value over time, which may grow our money.

Some people consider that they can impress others in the occasion that they present how a lot cash they have. These types of individuals go out to events every week, plan a visit overseas each month, and bask in excessive shopping. They additionally spend some big cash on particular events like weddings, birthday parties, or anniversaries. But for the overspending, the case is completely completely different. People who spend money on meaningless things are losing their time and effort.

Michelle created an in-depth course that I’m also at present going by way of to start out making extra money from home. It’s called Making Sense of Affiliate Marketing, and she even offers a payment plan on the course. If you’re going to spend cash on one thing for yourself, it’d as nicely be one thing you can use to grow your income!

Start by monitoring your bills for a few months. With your Jeanne D’Arc Credit Union account, use on-line banking to get your latest debit and credit card statements, together with any receipts you might have for cash transactions. Credit playing cards could be a useful tool when managing funds.

Your “budget buddy” can encourage you (and your social network) to decide on lower-cost leisure and restaurant choices. It may sound simpler than you suppose, but when an item you want is staring you in the face, it may be hard to say no. That’s why if you’re looking to curb your overspending, it’s essential to assume forward to future bills. It may be straightforward to begin out overspending when you don’t have a clear concept of how a lot money you’re truly spending every single day. As associates, family and abilities dwindle, retail therapy can provide many individuals a short-lived temper enhance.